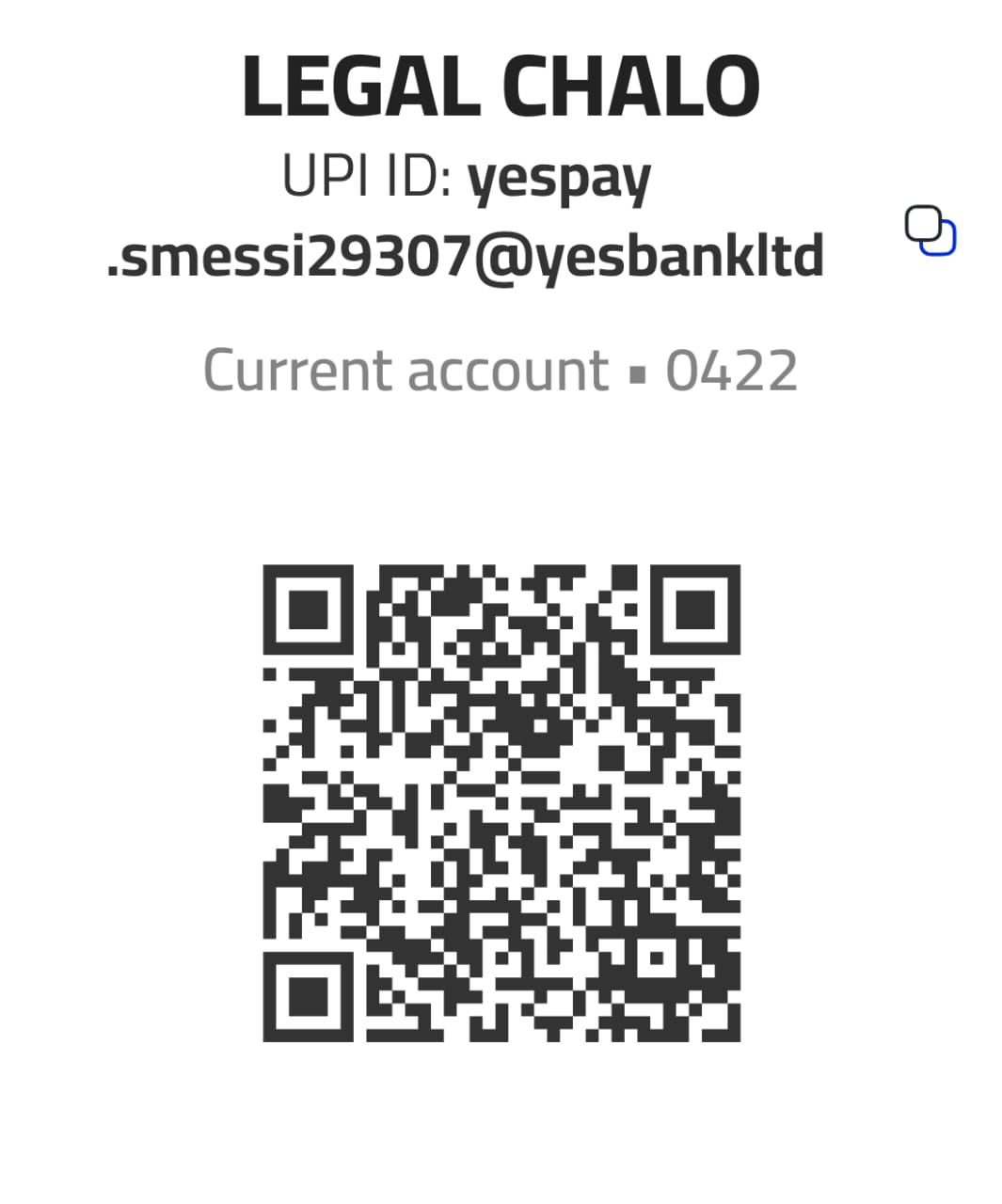

legalchalo@gmail.com +91 9990363345

PRIVATE LIMITED COMPANY REGISTRATION IN INDIA

A "company means a company incorporated and registered under the companies Act, 2013 (the Act) or under any of the previous company law" therefore a company is an association of person consists of both natural and artificial under the existing law of a country. A company is a "legal person" or "legal entity" seperated and distinct from its members.

Registration Packages

Our offices are in Delhi, Noida, Ghaziabad and we provide registrations and licenses services online all over India.

-

PRIVATE LIMITED COMPANY

-

Rs. 7,999/-

-

Digital Signature for 2 Directors

-

DIN for 2 Directors

-

Name Approval

-

MOA/AOA

-

ROC Registration Certificate

-

Comapny PAN

-

Company TAN

-

LIMITED LIABILITY PARTNERSHIP

-

Rs. 6,999/-

-

Digital Signature for 2 Partners

-

DPIN for 2 Directors

-

Name Approval

-

LLP Agreement

-

ROC Registration Certificate

-

Comapny PAN

-

Company TAN

-

ONE PERSON COMPANY

-

Rs. 6,999/-

-

Digital Signature for 1 Director

-

DIN for 1 Directors

-

Name Approval

-

MOA/AOA

-

ROC Registration Certificate

-

Comapny PAN

-

Company TAN

Private Limited Company Registration in India With Legal Chalo

Procedure of Registration of Private Limited Company in India

- Make Dsc Of Directors

- Din Of Directors

- Name Availability

- Drafting Of MOA & AOA

- Filing of Relevant e-form with ROC

- Payment of ROC Fees & Stamp duty

- Verification Of Document with ROC

- Issue of Certificate of Incorporation With ROC

Advantages for registring the private limited company

- Corporate Identity

- Limited Liability

- Business will set up in more organized manner

- Easily take loans form bank

- More clients

- More Growth & Development

- Efficients and Effectiveness will increase

- Better Managemnt Practices will follow

Required Documents for Private Limited Company Registration

1). ID's and Address Proof of all Directors (PAN Mandatory)

2). Address proof of Registered office Address (Rent Ag.)

3). A4 Size Photograph of all Directors

4). Other Affidavits and Documents

Key Steps to Successfully Registration of Your Private Limited Company in India

1). ID's and Address Proof of all Directors (PAN Mandatory)

2). Address proof of Registered office Address (Rent Ag.)

3). A4 Size Photograph of all Directors

4). Other Affidavits and Documents

Following points should be kept in mind while registration of a private limited company.

1). Lawful purpose of the members.

2). Promoters – at least seven in a public company, at least two a private limited company and one a one person company;

3). Promoters must subscribe their names to the memorandum of association of the company;

4). Promoters must comply with the requirements of the Companies Act, 2013 in respect of registration of the company.

5). The minimum paid-up capital can be rupees one lacs in case of a private limited company regsitraiton in India.

A company may be formed for any lawful purpose which required –

1). Seven or more persons, to registration of a public limited company.

2). Two or more persons, to registration of a private limited company registration; or

3). One person, to registration of a One Person Company that is to say, a private limited company, by subscribing their names to a memorandum and complying with the requirements of this Act in respect of registration.

Procedure for registration of Private Limited Company in India

1). ID's and Address Proof of all Directors (PAN Mandatory)

Director required to make a digital signature certificate for signing the e-form as the forms filed by the director are required to be digitally signed and for making the digital signature of director we need to apply to the licenced certifying Authority as the DSC should be secure and for making the DSC we need to give one ID and and one address proof of each the director required to make the digital signature certificate (DSC). you can also take the help of our portal i.e. Legal Chalo.

2). Obtain Director Identification number (DIN).

The director should need to file e-form DIR-3 for obtaining the Director identification number (DIN). however you can also obtain DIN number with the help of Legal Chalo.

3). Check the name availability of the proposed company.

Legal Chalo can also provide you the facility for proposing the maximum six names. The application is required to be made in INC-1 using Digital Signature Certificate.

Following documents have to be submitted with INC-1

a). Copy of Board Resolution for registration of a private limited company or public limited company as the case may be.

b). Other document as per the specific requirement. (depend from case to case). The name which is available to the applicant is reserved for the 60 days from the date of approval. if the applicant not used the proposed name within the 60 days the name will elapased

4). Drafting and printing of Memorandum and Article of Association of the company.

After ascertaining the name of the company the company need to draft the memorandum of association and article of association of the proposed company and printed.

The memorandum and articles of association of the company is as per the confirmitty of the companies act.

5). Stamping and signing of memorandum and article.

The memorandum and article should be printed and signed by the subscriber however there is a facility of online stamping.

6). Dating of Memorandum and article of association of the company

After stamping and signing the company need to dated its article and memorandum of association the date should not be prior to the date of stamping.

7). Filing of documents and forms with the registrar of company.

a) MOA and AOA duly signed by all subscribers.

b) A declaration by - company secretary and a person name in the director that all the requirement of the companies act have been complied.

c) An affidavit from each subscriber.

d) Registered office address

e) Identity Proof along with particulars of each subscriber.

f) Identity Proof along with particulars of first directors.

Following Documents are required with these forms.

1) Memorandum of Association (MOA)

2) Article of Association

3) Declaration in form INC-8

4) Affidavit in form INC-9

5) Proof of residential Address

6) Proof of Identity

7) NOC

8) Proof of nationality(in case the subscriber is foreigner

9) Pan Card

10) Copy of Certificate of registration of a foreign body corporate and registered office address.

11) Copy of resolution for authorising to subscribe the memorandum of association .

After submitting all the form along with the necessary document Registrar of company (ROC) will check the document and then issue a certificate of Incorporation.

FAQ ON REGISTRATION OF PRIVATE LIMITED COMPANY?

1. How many minimum directors in required to incorporate a private limited company?

Ans. At the time of registration minimum 2 director are required for private limited company registration.

2. How many members required for private limited company registration in India?

Ans. Minimum 2 member are required for registration of private limited company.

3. What are the maximum number of directors in private limited company registration in India?

Ans. Maximum 15 director can appoint in private limited company.

4. What are the Maximum number of members in private limited company registration in India?

Ans. Maximum member limit is 200 in private limited company. However, it may be different in any other type of company. Therefore, it depends on the category of the company which we are registering.

4.1 What is the content of articles required to be drafted in private limited company registration in india?

Ans. Contents of The Article of Association i.e. AOA

a) It contains the information about the share capital of the company.

b) Details of director’s qualification, appointment, powers, remuneration, duties etc. of the company

c) Rules regarding company dividends and reserves

d) Details regarding company accounts and audit of company.

e) The company’s borrowing powers provisions also there

f) Provisions relating to conducting meetings

g) Process of winding up of the company

5. How moa and aoa drafted at the time of private limited company registration in India?

CONTENT OF MEMEORANDUM OF ASSOCIATION

A Memorandum of Association (MOA) is a very important document which contains details regarding the main objects of the company it covers two section one is about the main objects of the company and the other is about the ancillary and other object of the company it includes all the objects of the company with are directly related to the main objects of the company however company may amend the main object of the company from time to time as he may deem fit for changing the object clause of the company company need to file special resolution which means that more than seventy five percent of the majority will give the decision in your favour. It is known as Company’s charter. It lays down the scope and objects of the company’s function and its objectives for which it is registered its also determine the scope and its relationship with the other country.

The first step for company registration is to draft the memorandum of association of the company. at the time of registration of the company the member of the subscribers subscribes the MOA

Contents of MOA

a) Every Company Contains Five clauses which are given below:

b) Name clause for the name of the company

c) Registered office clause for the registered office address of the company

d) Object clause which explains the main object and other objects of the company.

e) Liability clause talk about the maximum liability of the company.

f) Capital clause talks about the maximum capital of the company.

ABOUT AOA MEANS ARTICLE OF ASSOCIATION

The Articles of Association (AOA) of the company contains its rules and regulations or bye-laws that govern or control the conduct of its business and manage the internal affairs of the company. The AOA is subordinate to the MOA of a company and is governed by the Memorandum of Association of the Company. Every company must have an Articles of Associations as it plays a very important role in describing the company internal rights, duties, functioning, managements and their workings. The contents of article of associations should be in accordance with the memorandum of association and the Companies Act, 2013.

6. What are the provisions of Transfer of shares in private limited company?

As per Section 2 sub-section (68) of the Companies Act, 2013, and rules made thereunder a Private Company is required to restrict the right to transfer its shares by its articles of association of the company registered as per company act, 2013. For legal transfer, provisions or restrictions contained in the Article of the company must be duly complied by the transferee, transferor, and the Company whose shares are required to be transferred. .

The logic behind putting this restriction in AOA of a Private limited Company is to maintain or preserve the promotor of shareholding. However, just to preserve the composition, there should not be an absolute ban on right to transfer shares. Therefore, Table F of Schedule I which is normally adopted by a Private limited Companies as their AOA, places certain reasonable conditions which needs to be complied from time to time for effecting a proper transfer.

7. Can we do Issue of security in private limited company registration?

Ans. The Article of Association of the company restricts the transfer of shares to the public.

Whereas private limited company can issue shares to his Existing member through private placement or preferential allotment after comply the legal requirements of companies act, 2013 and rules made thereunder.

8. How much Paid-up share capital required for incorporation of in private limited company?

Ans. As such no paid-up share capital is required at the time of registration of a private limited company in India. However earlier there was a limit of Rs. 1,00,000 paid up capital as minimum capital required for registration.

9. How much Authorized share capital required for incorporation of in private limited company registration in India?

Ans. Authorized share capital, also known as the nominal capital of the company, which refers to the maximum amount of share capital of the company that a private limited company is authorized to issue to its shareholders.

10. What are the Documents required for private limited company registration in India?

Ans. Following document id required for registration of a private limited company.

a) Identification Proof. – copy of Pan Card and Aadhar Card of director

b) Address Proof. – Electricity bill which should not be older than 2 Months

c) Business Address Proof, any

d) Bank Statement of Directors. Should not be older than 2 months

e) Recent Passport Size Photograph

f) Memorandum of Association of the Company

g) Article of Association of the company

h) Professionals' Declaration.

11. What are the Documents required for director in private limited company registration in India?

a) Copy of PAN Card

b) Copy of proof of identity and

c) residence, a recent photograph, and

d) a Digital Signature Certificate (DSC).

e) Unique email id and mobile No.

12. What are the Documents required for proof of Registered office in private limited company registration in India?

Ans. Copy of latest Electricity bill and NOC from owner is required for proof of Registered office for private company Registration.

13. Is DIN mandatory required for appointing a director in a private limited company registration in India?

Ans. No DIN is not mandatory for Director at the time of incorporation of private limited company because Application for DIN is simultaneously filed along with SPICE FORM.

14. Is Digital signature certificate Required for Director in private limited company registration in India?

Ans. YES, DSC is required for the sign of director in various incorporation forms at the time of incorporation of company.

15. Is Digital signature certificate Required for member in private limited company registration in India?

Ans. YES, DSC is Required for the signature of Member in various incorporation forms including subscriber sheet at the time of incorporation of company.

16. How many days it will take in registration of a private limited company in India?

Ans. a private limited company registration may usually take 5-7 days.

17. What is private limited company registration?

Ans. Private Limited Company registration is the most common and popular form of registration in India which is governed by the company Act,2013 and the company incorporation rules, 2014 and other rules made thereunder.

For registering a private limited company, a minimum number of two shareholders and two directors are required. MCA has recently implemented major changes in the process of registration and made it clear and simple to register a company.

18. Liability of members after private limited company registration is limited or not?

Ans. After the registration of a private limited company, the liability of its members is limited. Which is one of the key characteristics of a private limited company.

Limited liability means that the shareholders' liability for the company's debts and obligations is limited to the amount of paid-up capital they have invested in the company. In other sense, the personal assets of the shareholders are generally protected from the company's liabilities. If the company were to face financial difficulties or legal claims, the shareholders would not typically be personally responsible for covering those debts beyond their investment in the company.

19. Stamp duty require to pay at the time of private limited company registration in India?

Ans.The requirement for stamp duty payment at the time of private limited company registration in india can vary depending on the jurisdiction where the company is being registered for more specific details you can contact the expert of legal Chalo.

20. How many Types of private limited company registration in india?

Ans. In most jurisdictions, including many countries like India, the UK, and others, private limited companies can be registered under various types. Here are some common types of private limited company registrations:

Company Limited by Shares (CLS): This is the most common type of private limited company where the liability of members is limited to the amount unpaid on their shares. It can be further classified into:

Private Company Limited by Shares: This is the standard private limited company where ownership is divided into shares, and the liability of shareholders is limited to the amount unpaid on their shares.

Private Unlimited Company: In this type, there is no limit to the liability of members. However, it is less common than a private company limited by shares.

Company Limited by Guarantee (CLG): In this type, the liability of members is limited to the amount they agree to contribute to the assets of the company in the event of its winding up. This type of company is often used by non-profit organizations, clubs, and associations.

Company Limited by Shares with Guarantee: This type combines features of both CLS and CLG. It has shareholders whose liability is limited by shares and members whose liability is limited by guarantee.

Unlimited Company: In this type of company, there is no limit to the liability of the members. This means that members are personally liable for the company's debts and obligations without any limitation.

One Person Company (OPC): Some jurisdictions allow for the registration of a private limited company with only one member. This type is suitable for entrepreneurs who want to enjoy the benefits of limited liability while being the sole owner of the company.

Small Company: In certain jurisdictions, there are provisions for small companies that have less stringent regulatory requirements compared to larger private limited companies. These provisions may include exemptions from certain reporting and audit requirements.

Special Purpose Vehicle (SPV): This type of private limited company is often used for specific purposes such as holding assets, facilitating joint ventures, or carrying out specific projects. SPVs are commonly used in finance, real estate, and infrastructure projects.

It's important to note that the specific types of private limited company registrations available may vary depending on the country's laws and regulations. It's advisable to consult with legal and financial experts when choosing the most suitable type of private limited company registration for your business.

21. From where private limited company registration done?

Ans. When considering why you should choose us for private limited company registration services, here are some compelling reasons:

Expertise and Experience: We have a team of experts with extensive experience in company registration processes. We understand the legal requirements, documentation, and procedures involved in registering a private limited company, ensuring a smooth and efficient process for our clients.

Compliance and Legal Knowledge: We stay updated with the latest regulations and legal requirements related to company registration. Our knowledge and expertise ensure that your company registration is compliant with all relevant laws and regulations, avoiding any potential issues or delays.

Tailored Solutions: We provide personalized and tailored solutions based on your specific business needs and objectives. Whether you are a startup, small business, or established company, we customize our services to meet your requirements and facilitate your company registration process effectively.

Efficiency and Timeliness: We prioritize efficiency and timeliness in our services. Our streamlined processes and proactive approach ensure that your company registration is completed within the stipulated timelines, allowing you to focus on other aspects of your business.

Transparent Communication: We believe in transparent communication throughout the company registration process. Our team keeps you informed about the progress, requirements, and any updates related to your registration, ensuring clarity and peace of mind.

Cost-Effective Solutions: We offer competitive pricing for our company registration services, providing you with cost-effective solutions without compromising on quality. Our transparent pricing structure ensures that you know the fees upfront, avoiding any surprises or hidden costs.

Post-Registration Support: Our services extend beyond company registration. We provide post-registration support and guidance on compliance, filings, and ongoing legal requirements, helping you navigate the complexities of running a private limited company successfully.

Overall, choosing us for your private limited company registration offers you expertise, compliance, efficiency, transparency, and ongoing support, making the registration process hassle-free and ensuring that your business starts on the right foot.

22. Which government website is required for private limited company registration?

Ans. Website of Ministry of corporate Affairs is required for registration of private limited company in India> no other website is authorized for the registration.

23. Who can be a director of a private limited?

Ans. Only a natural person can be a director in a company. Thus, an artificial person, such as a company, corporation, firm, entity or association, cannot be appointed as a director.

The following persons are eligible to be appointed as a director in a company:

a) The person should be above 21 years and below 70 years.

b) The person should have a sound mind.

c) The person should not be an undischarged insolvent.

d) The person should not have applied to be adjudicated as an insolvent.

e) The person should not have been convicted by a court of an offence and sentenced to imprisonment for more than six months, and a period of five years should have elapsed from the expiry of the sentence.

f) There should not be any order in force passed by a court or tribunal disqualifying the person for director appointment.

g) The person should have paid any calls in respect of any shares of the company held by him/her within six months from the last day fixed for the payment of the call.

h) The person should not have been convicted of the offence dealing with related party transactions under section 188 at any time during the preceding five years.

i) The person must have a Director Identification Number (DIN).

j) The person should not be appointed as a director in more than 19 companies or nine companies in the case of public companies since the maximum number of companies in which a person can act as a director is 20 companies or ten companies in the case of public companies.

k) A person cannot be appointed as a director if he/she is a director in the following companies:

l) A company that has not filed financial statements or annual returns for a continuous period of three financial years.

m) A company that has failed to repay the deposits, interest on deposits, failed to redeem any debentures on the due date, pay interest on debentures, or pay the dividend declared for more than one year.

24. How many proposed names we can file at the time of private limited company registration?

Ans. We can give maximum 2 proposed name for private company at the time of registration of private limited company in run form prescribed by the Ministry of Corporate Affairs after filing any name can be approved in the priority manner if no name is available then resubmission will come and user will get one more chance to file other new names for the approval. The fees for filing the name approval form are Rs. 1000/- which is non-refundable at any case. If in case form is rejected due to any reason then user need to file the form again along with the new fees payment slip.

25. Is professional certification is mandatory for private limited company registration?

Ans. Yes, professional certification is mandatory at the time of registration of a private limited company professional include chartered accountant, company secretary, cost and work accountant and any other professional prescribed by the Government from time to time.

26. which professional certification is mandatory for private limited company registration?

Ans. Only company secretary, chartered Accountant or cost and work Accountant in practice is authorized for certification of various forms in the registration of private limited company.

27. is it mandatory to fix registered office at the time private limited company registration in Inida?

Ans. No, Fixing of Registered Office is not mandatory at the time of private limited company registration however in case of non-fixing of registered office company need to fix its registered office of the company within one month from the date of registration.

28. Common seal is required at the time of private limited company registration in India?

Ans. Common seal is not mandatory at the time of registration of private limited company however it would require earlier after seeing difficulties in the operation of the business the provision of common seal is deleted from the company incorporation rules.

29. Can PAN separately need to apply at the time of private limited company registration in India?

Ans. No need to apply PAN separately because at the time of registration of private limited company, Application for PAN is simultaneously applied in the SPICE FORM. And PAN Number is allotted as and when company is registered and PAN number is mentioned on the certificate of Incorporation of the company.

30. Can TAN separately need to apply at the time of private limited company registration in India?

Ans. No need to apply TAN separately because at the time of registration of private limited company, Application for TAN is simultaneously applied in the SPICE FORM. And TAN Number is allotted as and when company is registered and TAN number is mentioned on the certificate of Incorporation of the company.

31. Can Bank Account separately need to apply at the time of private limited company registration in India?

Ans. No need to apply Bank Account separately because at the time of registration of private limited company, Application for Bank account is simultaneously applied in the SPICE FORM. And bank account Number is allotted as and when company is registered.

32. Can GST Registration need to apply at the time of private limited company registration in India?

Ans. Yes, you can apply for GST registration at the time of registration of private limited company. Registration process under GST is now integrated with SPICe+ AGILE Pro Form (or) SPICe-AGILE Form. However, it is not mandatory to apply for GST Registration at the time of Incorporation user has the option to apply with the registration or waive off at the time of registration because GST Registration is mandatory only for those enterprises whose having turnover is more than Lakhs.

33. Can PF Registration separately need to apply at the time of private limited company registration in India?

Ans. NO Need to apply PF registration separately at the time of registration of private limited company you can apply for PF registration at the time of registration of company. Registration process under PF is now integrated with SPICe+ AGILE Pro Form (or) SPICe-AGILE Form.

34. Can ESI Registration need to apply at the time of private limited company registration in India?

Ans. NO Need to apply ESI registration separately at the time of registration of private limited company you can apply for ESI registration at the time of registration of company. Registration process under ESI is now integrated with SPICe+ AGILE Pro Form (or) SPICe-AGILE Form.

35. Can (Labour Identification Number) LIN Number need to apply at the time of private limited company registration in India?

Ans. NO Need to apply LIN Number separately at the time of registration of private limited company you can apply for LIN Number at the time of registration of company. Registration process under LIN Number is now integrated with SPICe+ AGILE Pro Form (or) SPICe-AGILE Form

36. What required to be check for name avaibility at the time of private limited company registration in India

Ans. First, we check the proposed name in the master data of ministry of corporate Affairs(mca) and also check proposed name in the website of Trademark at the time of filing of SPICE PART-A for the apply for proposed name because our name should not be similar and identical with the existing one as per the naming guidelines issued by the ministry of corporate affairs from time to time.

37. Why should I choose legal Chalo for private limited company registration in India?/b>

Ans. Team of Legal Chalo help you in choosing unique name different from the existing one so that the chances of rejection your form is reduced to zero percent and help you in registering your private limited company in easy and continent manner.

38. What are the Benefits of private limited company registration in India?

Ans. Following are the benefit for the registration of private limited company in India

Limited Liability: Shareholders' liability is limited to the extent of their shareholding in the company. Their personal assets are generally protected from the company's debts and liabilities, providing a shield against financial risks.

Separate Legal Entity: A private limited company is considered a separate legal entity distinct from its shareholders. This means the company can own assets, enter into contracts, and sue or be sued in its own name, providing a sense of credibility and professionalism.

Ease of Ownership Transfer:Shares of a private limited company can be easily transferred among its shareholders, subject to any pre-emption rights or transfer restrictions specified in the company's Articles of Association.

Perpetual Succession: The existence of a private limited company is not affected by the death or departure of its shareholders or directors. It continues to exist unless it is wound up or dissolved according to the provisions of the Companies Act, 2013.

Access to Funding: Private limited companies have various options to raise capital, including equity funding from investors, venture capitalists, or angel investors. Additionally, they can issue debentures, take loans from financial institutions, or access government schemes for funding.

Tax Benefits: All Private Companies are eligible for various exemptions, incentives and tax deductions provided by the government. Additionally, they benefit from lower corporate tax rates for small companies as per the Income Tax Act.

Credibility and Trust: Being registered as a private limited company enhances the credibility and trustworthiness of the business in the eyes of customers, suppliers, and potential investors. It signals a commitment to compliance and professionalism.

Employee Stock Option Plans (ESOPs): Private limited companies can implement ESOPs to attract and retain talent by offering employees the opportunity to purchase or receive shares of the company at a predetermined price, thus aligning their interests with the company's growth.

Limited Compliance RequirementsPrivate limited companies have relatively fewer compliance requirements compared to public limited companies, making them suitable for small to medium-sized businesses.

Brand Protection: Registering a company name provides legal protection against others using the same or similar name within the jurisdiction, safeguarding the company's brand identity and reputation.

Disadvantages of private limited company registration

Following are the Disadvantages of private limited company registration

Regulatory Compliance: Private limited companies in India must comply with various statutory requirements, including filing annual returns, conducting board meetings, maintaining statutory registers, and adhering to accounting standards. The compliance burden can be substantial, particularly for small businesses with limited resources.

Cost of Compliance: Meeting regulatory requirements and maintaining statutory records can be expensive. Companies may need to allocate significant resources towards professional services such as legal, accounting, and auditing fees, which can increase operational costs.

Complex Formation Process: The process of registering a private limited company in India involves several legal formalities, documentation, and administrative procedures. This complexity can be daunting for first-time entrepreneurs and may require professional assistance, leading to delays and additional expenses.

Disclosure Requirements: Private limited companies in India are required to disclose certain information to regulatory authorities, including financial statements, shareholder details, and director information. This level of transparency may not be desirable for businesses that prefer to keep their financial and operational information confidential.

Restrictions on Share Transfer: Private limited companies often have restrictions on the transfer of shares, which may require the approval of existing shareholders or comply with pre-emption rights specified in the company's Articles of Association. This can limit liquidity and flexibility in raising capital or exiting the business for shareholders.

Limited Access to Capital Markets: Unlike public limited companies, private limited companies cannot raise funds from the general public through the issuance of shares or debentures on stock exchanges. Access to capital markets is restricted, and fundraising options may be limited to private investors, venture capitalists, or loans from financial institutions.

Ownership and Control: As the company grows, conflicts may arise among shareholders regarding ownership, control, and decision-making authority. Disputes over strategic direction, dividend distribution, or management decisions can potentially disrupt the smooth operation of the business.

Exit Challenges: Exiting or winding up a private limited company in India can be complex and may require approval from regulatory authorities, creditors, and shareholders. Dissolution proceedings may involve liquidation of assets, settlement of liabilities, and compliance with legal formalities, which can be time-consuming and costly.

Tax Implications: While there are tax benefits associated with private limited companies in India, such as lower corporate tax rates for small companies, the overall tax structure may still be complex and subject to changes in tax laws and regulations, requiring ongoing tax planning and compliance efforts.

39. How much cost involve approx. in private limited company registration in India?

Ans. The cost of registering a private limited company can vary significantly depending on various factors such as the jurisdiction, the services included, legal fees, government fees, and additional requirements. Here is an approximate breakdown of the costs involved in private limited company registration in India:

Legal and Professional Fees: This includes the fees charged by lawyers, consultants, or professional services firms for assisting with the company registration process. The fees can vary based on the complexity of the registration, the level of support required, and the reputation and experience of the service provider. On average, legal and professional fees can range from a few hundred to several thousand dollars.

Government Fees: Most jurisdictions require payment of government fees for company registration. These fees can include incorporation fees, stamp duties, registration charges, and other administrative costs. The exact amount depends on the country or state where the company is being registered. In some cases, there may be different fee structures for local companies and foreign-owned companies.

Name Reservation Fees: Before registering a company, you may need to reserve a name for your business. Some jurisdictions charge a fee for name reservation, which is usually separate from the incorporation fees.

Documentation Costs: There are costs associated with preparing and filing the necessary documents for company registration. This includes drafting the Memorandum and Articles of Association, preparing statutory forms, and obtaining notarization or authentication where required.

Additional Services: Depending on your requirements, you may incur additional costs for services such as obtaining a registered office address, appointing a company secretary (where mandatory), obtaining a tax identification number, and other related services.

Compliance Costs: After registration, there may be ongoing compliance costs such as annual filing fees, statutory audit fees (if applicable), company secretarial services, and other regulatory compliance expenses.

It's important to note that the above costs are approximate and can vary based on the specific circumstances of each company registration. Additionally, the costs may be different in different countries or regions. It's advisable to consult with legal and financial experts to get a precise estimate of the costs involved in registering a private limited company in your jurisdiction.