legalchalo@gmail.com +91 9990363345

FOR OPPRESSION AND MISMANAGEMENT CALL 9990363345

OPPRESSION AND MISMANAGEMENT

MEANING OF OPPERESSION AND MISMANAGEMENT

The simple meaning of ‘Oppression’ is that it is an unjust(unfair) or cruel exercise of authority/ power. Whereas,‘Mismanagement’ means conducting affairs in some prejudicial (adverse), dishonest or inept (incapable) manner. .

Who can file application under section 241 for Relief in Cases of Oppression and mismanagement/b>

Only member of the company can file application; Whereas creditor of the company cannot file this application

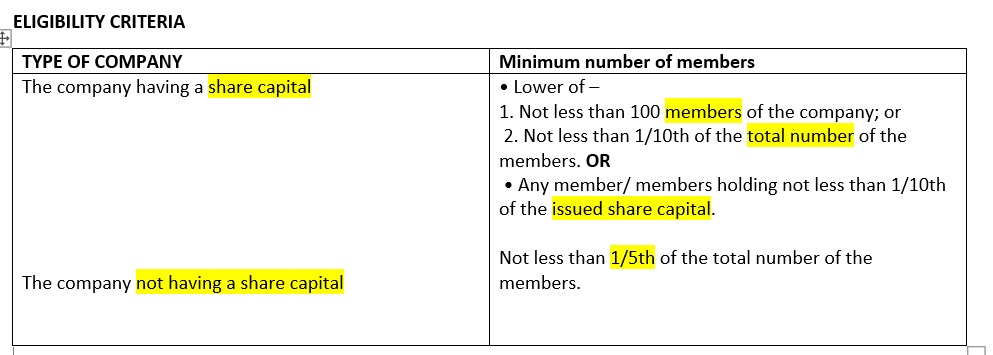

ELIGIBILITY CRITERIA

IMPORTANT POINT

1. Tribunal has the right to waive all/ any of the above requirements of the minimum number of members for filing an application to the Tribunal.

2. One or more members can make an application, on behalf of all, after obtaining consent in writing from the rest of the members.

APPLICATION TO TRIBUNAL FOR RELIEF IN CASE OF OPPRESSION

Circumstances under which application can be filed to the Tribunal-

POWER OF TRIBUNAL (section-242)

provision of Section 242 of the Companies Act defines powers available to the Tribunal on ‘Oppression’ and ‘Mismanagement’ application done by the member. Accordingly, if the Tribunal is of the opinion that the affairs of the company are being conducted in a manner prejudicial to the interest of the members, public or company then it has the power to pass the order as deemed fit. The order may provide for any of the following –

1. Regulation of conduct of the affairs of a company in future.

2. Purchase of either shares or interest of the members by other members.

However, in case the shares are purchased by the company, there should be a consequent reduction in its share capital.

3. Restriction on the transfer/ allotment of the shares of the company.

4. Termination/ setting aside/ modification of any agreement between the company and the managing director/ any other director on specific terms and conditions.

5. Termination/ setting aside/ modification of any agreement between the company and any person. Notably, such termination/ setting aside/ modification is possible only after due notice and consent from the concerned party.

6.Setting aside any transfer/ delivery/ execution/ payment or any act related to the property which is made by or against the company within a period of three months before the date of application

7. Removal of managing director/ manager/ any other director of the company and manner of re-appointment of the same.

8. Recovery and manner thereof of undue gains made by the managing director/ manager/ director.

9. Appointment of directors who are required to report to the Tribunal.

10. Levy of costs as Tribunal deemed fit.

CONSEQUENCES OF TERMINATION OR MODIFICATION OF CERTAIN AGREEMENT (section -243)

243. (1) Where an order made under section 242 terminates, sets aside or modifies an agreement such as is referred to in sub-section (2) of that section, —

(a) such order shall not give rise to any claims whatever against the company by any person for damages or for compensation for loss of office (MD/WTD/MANAGER UNDER SECTION 202) or in any other respect either in pursuance of the agreement or otherwise;

(b) no managing director or other director or manager whose agreement is so terminated or set aside shall, for a period of five years from the date of the order terminating or setting aside the agreement, without the leave of the Tribunal, be appointed, or act (shadow director), as the managing director or other director or manager of the company (but can appoint in other company)

Provided that the Tribunal shall not grant leave under this clause unless notice of the intention to apply for leave has been served on the Central Government and that Government has been given a reasonable opportunity of being heard in the matter. (work of tribunal)

CLASS ACTION SUIT (SECTION-245) {NOT APPLICABLE FOR BANKING COMPANY}.

WHAT IS CLASS ACTION SUIT?

A class action suit is a lawsuit where a group of people representing a common interest may approach the Tribunal to sue or be sued.

It is a procedural instrument that enables one or more plaintiffs to file and prosecute litigation on behalf of a larger group or class having common rights and grievances.

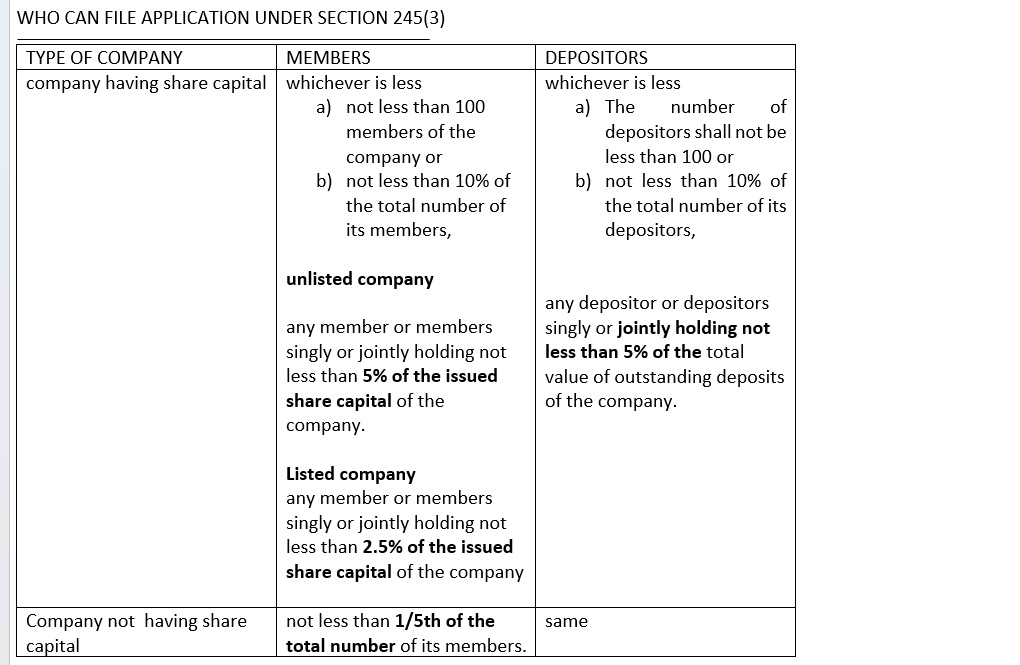

WHO CAN FILE APPLICATION UNDER SECTION 245(3)

Note:

(d) “depositor” means,

- Any member of the company who has made a deposit with the company in accordance with the provisions of sub-section (2) of section 73 of the Act, (member of company) or

- Any person who has made a deposit with a public company in accordance with the provisions of section 76 of the Act;(public)

Class action suit can be filed against the

- A company or its directors

- an auditor including audit firm.

- an expert or advisor or consultant OR Any Other Person (CEO, CFO, OFFICER)

CLASS ACTION SUIT CAN BE FILED BEFORE NCLT

WHAT KIND OF ORDER NCLT CAN GIVE ON CLASS ACTION SUIT?

- to restrain the company from committing an act which is ultra vires the articles or memorandum of the company;

- to restrain the company from committing breach of any provision of the company’s memorandum or articles;

- to declare a resolution altering the memorandum or articles of the company as void if the resolution was passed by suppression of material facts or obtained by mis-statement to the members or depositors;

- to restrain the company and its Directors from acting on such resolution;

- to restrain the company from doing an act which is contrary to the provisions of this Act or any other law for the time being in force;

- to restrain the company from taking action contrary to any resolution passed by the members;

- to claim damages or compensation or demand any other suitable action from or against—

- the company or its Directors for any fraudulent, unlawful or wrongful act or omission or conduct or any likely act or omission or conduct on its or their part;

- the auditor including audit firm of the company for any improper or misleading statement of particulars made in his audit report or for any fraudulent, unlawful or wrongful act or conduct; or

- any expert or advisor or consultant or any other person for any incorrect or misleading statement made to the company or for any fraudulent, unlawful or wrongful act or conduct or any likely act or conduct on his part;

- to seek any other remedy as the Tribunal may deem fit.

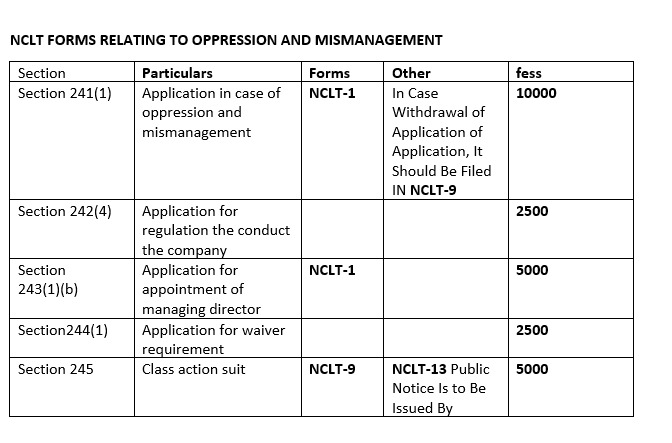

NCLT FORMS RELATING TO OPERASSION AND MISMANAGEMENT

DECIDED CASE LAW RELATING TO OPPRESSION AND MISMANAGEMENT

- oppression need not be only for pecuniary (Monetary) gain

- Unwise, Inefficient or Careless Conduct of a Director Is Not Oppression (SC)

- Dispute of oppression cannot be referred to Arbitration because relief claimed in company petition can not granted by Arbitrator (Bombay high court)

- But dispute or matter can be referred to Arbitrator, which the arbitrator is empowered to decide (madras high court)

- Every difference of opinion between the shareholder is not oppression

- Limitation Act not apply to tribunal

- Removal of director is oppression in quasi partnership

- Failure to declare dividend is not mismanagement

- Not maintenance of statutory register is not oppression

How legal chalo can assist you in the matter of oppression and mismanagement

We have a team of highly qualified professionals which include company secretary, Advocate, MBA, chartered accountant.

We have versed experience in the filed of oppression and mismanagement, removal of director, shifting of registered office, representative service, insolvency matter and all other matter related to NCLT.

If you are facing difficulties in the company for dealing in the affairs of the company in the following circumstances:

If the other director not coordinating with you, not responding you and not taking interest in the day-to-day business in your company.

Any director of the company refuses to sign on the cheque of the company

If the director of the company involves in some illegal activities

In all above case we have applied Removal of director of such concerned director. The removal of director from company is difficult most of time form is rejected by Central Government so you can approach LEGAL CHALO team.

Consultancy Services for Company Registration Our offices are in Delhi, Noida, Ghaziabad and we provide services all over India.

By continuing past this page, you agree to our Terms and Conditions and Privacy Policy | Copyright © 2022 . All Rights Reserved | Developed by Legal Chalo