legalchalo@gmail.com +91 9990363345

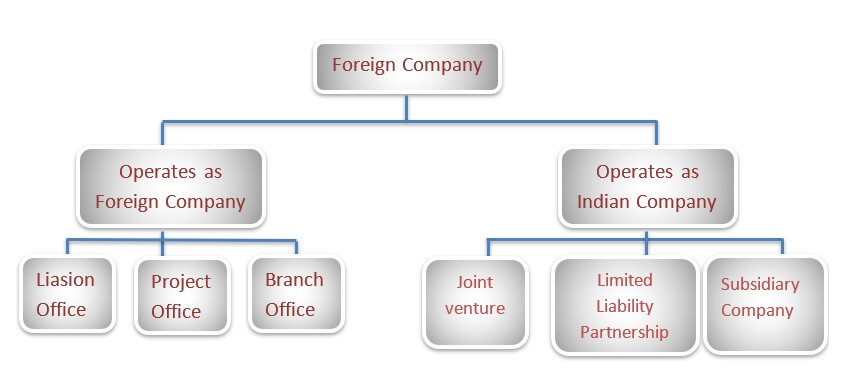

FORM OF ENTITIES TO OPERATE BY A FOREIGN COMPANY IN INDIA

Prospective companies and investors want to enter into the Indian market for investment and establishing a business presence. Liasion offices are a best option for foreign investors to explore the Indian market.

A Liasion office is an extended arm of the foreign company in India. It is the representative office in India and can undertake only liaison activities. A liaison office is subject to various conditions on activities.

Representing in India to its parent company/ group companies.

Promoting export/ import from/to India

Promoting the technical and financial collaborations between parent and group companies and companies in India.

Acting as a communication channel between the parent company and Indian companies.

A Liaison Office is not permitted to undertake any commercial/ Industrial activity, directly/ indirectly and therefore cannot earn any income in India.

A liaison office can neither borrow, nor lend money.

It cannot acquire, Hold, (except lease for a period not exceeding five years) transfer or dispose of any immovable property in India, without prior approval of RBI.

Liasion office is defined under The Foreign Exchange Management Act (FEMA), which governs the application and approval process for the setting up of a liaison or branch office in India. Under the Act, foreign enterprises obtain permissions from the Reserve Bank of India’s (RBI) and Foreign Exchange Department to establish a liaison office in the India.

While in case of Foreign insurance companies:

They can set up liaison offices in India after obtaining approval from the Insurance Regulatory and Development Authority (IRDA).

In case of Foreign banks

They can establish liaison offices in India only if they get approval from the Department of Banking Regulation (DBR), RBI.

The applications Form FNC Annex-1 (Application for Establishment of Branch / liaison Office in India) by entities are to be submitted.

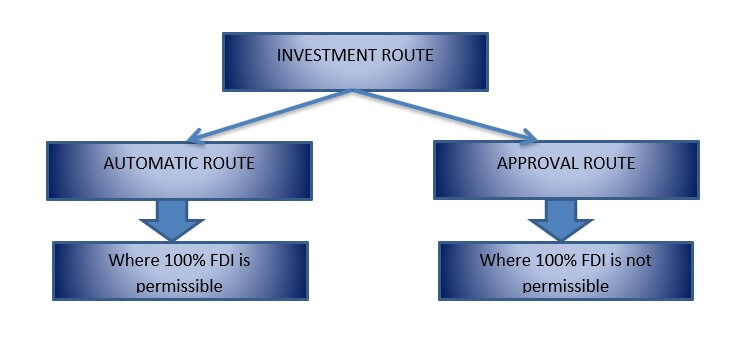

INVESTMENT ROUTE FOR LIASION OFFICE

In case of subsidiary-parent Company, parent company may submit a LETTER OF COMFORT on the subsidiary’s behalf.

FILING APPLICATION AND REQUIRED DOCUMENTS TO ESTABLISH LIASION OFFICE

The application for opening a liaison office is to filed in Form FNC-1 with AD Category-I Bank.

There are certain required attachments:

a) A notarized copy of the Certificate of Incorporation, memorandum and Article of Association and copy of last three years audited balance sheet of Parent Company.

b) Complete Address details of the parent company outside India.

c) A brief on business activity to be done at liaison office.

d) Bank details of the parent company

e) A Certificate from Banker of the parent company stating the commencement date and no default statement as per the prescribed format.

After verification and certification, RBI will permit the opening of liaison office. And RBI will provide the UIN to liaison office. Permission to set up such offices is initially granted for a period of 3 years and this may be extended from time to time by an “AD Category I bank”.

The AD Bank, in consultation with RBI, has the power to grant an extension for a further period of 3 years (subject to confirmation of certain compliance requirements).

The Liasion office should apply for extension at least 1/2 month before the expiry of the initial time period.

Afterwards apply for PAN number with Income tax authorities.

It is compulsory to register the liasion office with ROC within 30 days of setting up of establishment of liasion office by filing the form by MCA.

Translated and Notarized copy of the certificate of incorporation/ registration.

Translated and Notarized copy Charter, statutes or memorandum and articles of association or other Instrument constituting the constitution of the company.

List of directors and secretary of the foreign company

POA /Board Resolution in favor of authorized representative

RBI approval letter.

Closure of liasion office in India needs to be done with ROC & RBI.